DORA compliance is mandatory for EU financial institutions starting January 2025, with fines reaching €1 million or 2% of global turnover for non-compliance.

As financial institutions across Europe race to comply with the Digital Operational Resilience Act (DORA), a critical bottleneck has emerged—the DORA Register of Information (ROI) submission format.

The European Supervisory Authorities (ESAs) have provided structured Excel templates for collecting the required data. However, when it comes to actually submitting the report, only one format is accepted:

❌ Excel is not valid for submission

✅ Only XBRL (eXtensible Business Reporting Language) files will be accepted

This creates a major operational and compliance gap. Teams are doing the hard work of compiling data—only to find they can’t complete the process.

✅ Enter DORApp: From Excel to XBRL in One Workflow

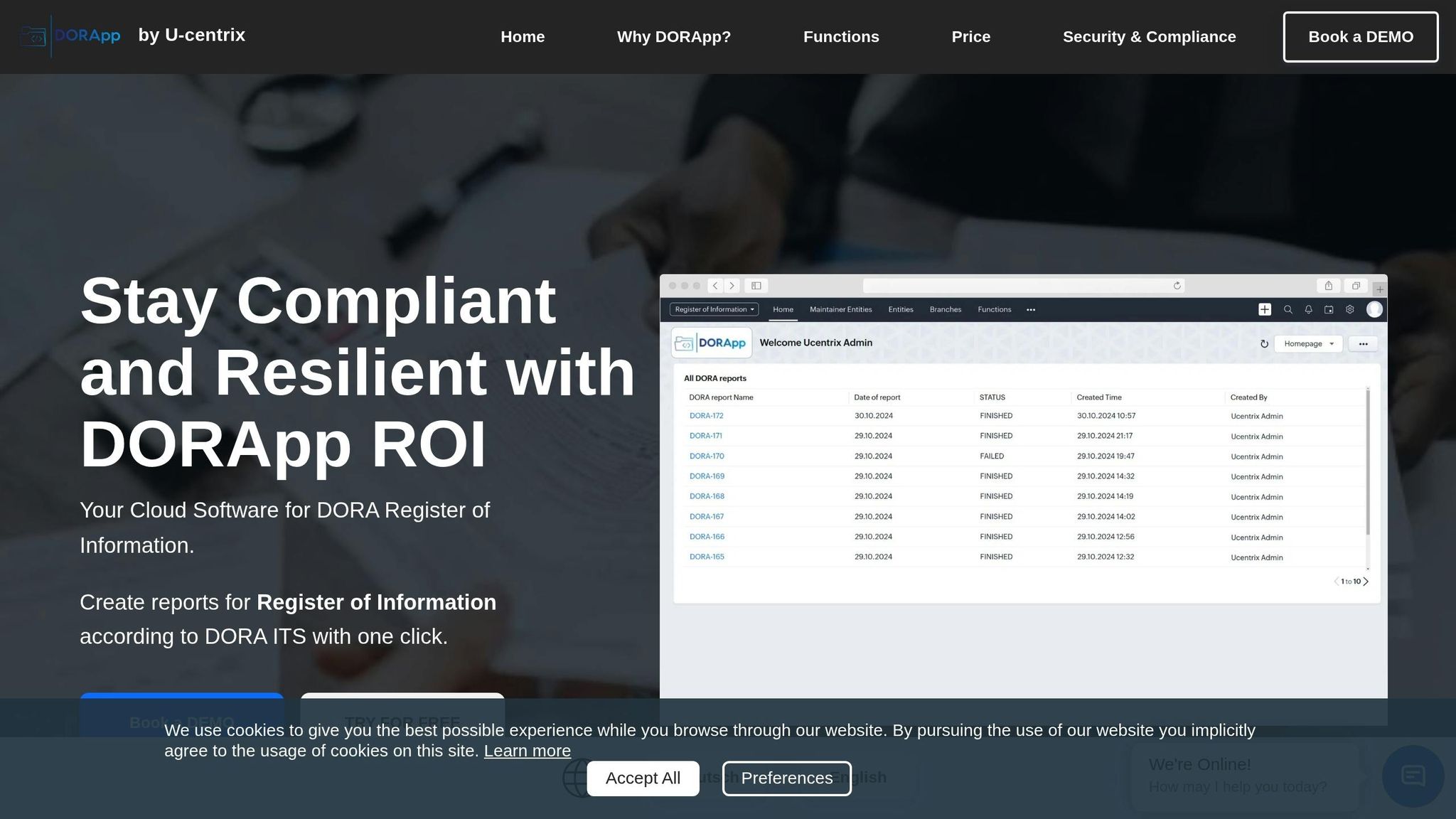

DORApp is a cloud-based solution designed to bridge the Excel–XBRL gap and help financial institutions comply with DORA ROI requirements with ease.

Key Benefits of DORApp

- Automated XBRL generation: Converts Excel data into DORA-compliant XBRL files.

- Real-time validation: Detects and corrects errors instantly.

- Cost and time savings: Streamlines reporting and reduces manual workload.

- Enhanced security: EU-based data centers with multi-factor authentication.

DORApp offers a step-by-step setup process, including data import, mapping to XBRL taxonomies, and automated report generation. It's a practical solution to meet DORA's January 2025 deadline while improving reporting accuracy and efficiency.

🔧 Key Features

🔄 Excel Import with Auto-Mapping

- Upload official ESA Excel or CSV templates

- Automatically match columns to DORApp modules (Entities, Service Providers, Contracts, etc.)

- Use predefined templates to eliminate manual mapping

📊 Data Validation & Enrichment

- Built-in validation engine highlights errors before submission

- Tooltips and dropdowns ensure correct data entry

- Optional automation pulls data from public sources to enrich records

🧾 XBRL Report Generation

- One-click generation of fully structured XBRL reports

- Automatically conforms to the ESA taxonomy

- Output: ZIP file in XBRL format, ready for submission

🔐 Audit Trail & User Management

- Role-based permissions

- Full activity logs for transparency and accountability

💡 Intuitive, Guided Workflow

DORApp doesn’t just convert files—it guides your entire ROI workflow.

Start with Maintainer Entities, and proceed step-by-step through Entities, Branches, Functions, Service Providers, Contracts, and more.

You’ll receive clear, actionable guidance on:

- Importing data in the correct sequence

- Validating records before export

- Fixing any issues during XBRL generation

No guesswork. No technical blockers. Just compliance, simplified.

📥 Real Output Example

When generating a report for the March 2025 deadline, DORApp produces:

485100YQJY3QBLNB0I07.CON_SI_DORA010100_DORA_2025-03-31_20250421141632000.zip

This file is fully compliant with the ESA XBRL format—ready for upload to your competent authority’s system.

🚀 Ready to Close the Compliance Loop?

More and more institutions are turning to DORApp to ensure seamless ROI reporting—from Excel to XBRL—before submission deadlines hit.

👉 Book a demo or try for free at dorapp.eu

Let’s turn your DORA compliance from a challenge into a streamlined process.

DORApp performs real-time validation to confirm reports meet the Central Bank's standards for naming and required fields.

sbb-itb-107f699

Maintaining DORA Compliance with DORApp

DORApp goes beyond just creating automated reports. It helps maintain compliance with DORA standards through regular updates, detailed auditing tools, and reliable support.

Regular System Updates

DORApp frequently updates its platform to stay in sync with the latest DORA requirements. These updates include improvements to taxonomy, compliance features, and security protocols - all designed to minimize workflow interruptions while safeguarding data integrity.

Audit and Report Features

The platform tracks essential DORA-related activities, such as user actions, report versions, and system access. Automated validation checks ensure data quality and compliance remain intact. This detailed tracking system makes it easier for organizations to prove they’re meeting regulatory standards.

Help and Support

Users can access a wide range of resources, including detailed documentation, technical guides, and training sessions, all available on the web portal. For more complex compliance or technical challenges, expert support is just a call or message away, helping users get the most out of DORApp.

Conclusion: Simplified DORA Reporting

Key Advantages

DORApp makes DORA ROI reporting easier by automating repetitive tasks. Its automated XBRL generation helps reduce errors and speeds up the reporting process. With built-in LEI verification and data enrichment, the platform ensures accuracy without the need for manual input, saving time and effort.

The secure cloud infrastructure adheres to EU data protection standards, keeping financial data safe while remaining accessible for regulatory submissions. These features make implementation straightforward and efficient.

How to Get Started with DORApp

DORApp simplifies DORA compliance from the start. The platform supports data imports in commonly used formats like Excel and CSV, making it easy to transition from your current systems.

The Enterprise plan, priced at €200 per user per month, includes the following:

| Implementation Phase | Key Activities | Outcome |

|---|---|---|

| Initial Setup | Import data and verify LEI | Establish a validated data foundation |

| Configuration | Set up third-party providers and manage contracts | Streamlined vendor management |

| Report Generation | Create and validate XBRL reports automatically | Submissions that meet DORA standards |

Once registered, you'll be assigned a dedicated representative to guide your setup. Regular updates and strong support make it easier to adjust as requirements change.