Struggling with DORA compliance? Financial institutions must decide: buy off-the-shelf software or build custom solutions. Each option has its strengths and weaknesses, depending on your organization's needs, budget, and timeline.

Quick Overview:

- Off-the-Shelf Software: Faster to implement, predictable costs, vendor-managed updates, but limited customization and potential vendor lock-in.

- Custom Development: Tailored features, better integration, full control, but higher upfront costs, longer timelines, and ongoing maintenance demands.

Quick Comparison:

| Feature | Off-the-Shelf | Custom Development |

|---|---|---|

| Implementation Speed | 10 days to 3 months | 6-18 months |

| Cost | €100K-€500K initial | €500K-€2M initial |

| Customization | Limited | Fully tailored |

| Maintenance | Vendor-managed | Internal or contracted |

| Scalability | May require adjustments | Built for specific needs |

Key takeaway: Smaller institutions benefit from off-the-shelf solutions for speed and simplicity, while larger, complex organizations often need custom systems for precise compliance and integration.

Read on for detailed pros, cons, and real-world examples to help you make the best choice for your DORA compliance strategy.

Ready-Made Software Analysis

Pre-built DORA compliance software provides financial institutions with a quicker way to meet regulatory requirements. It supports automated incident workflows, as outlined by DORA, but introduces new dependencies along the way.

Benefits of Ready-Made Solutions

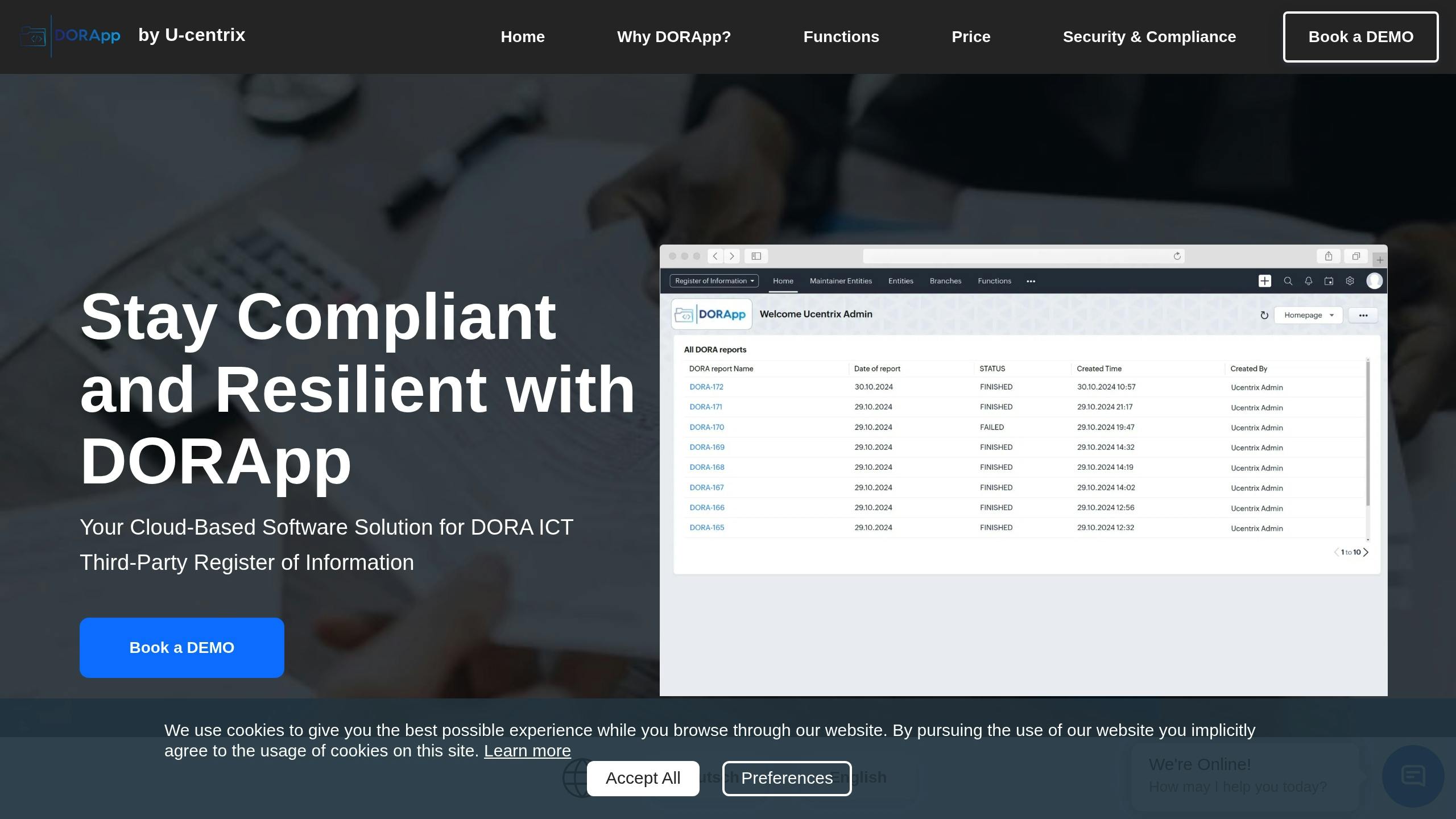

Platforms like DORApp, a well-known DORA compliance tool, offer features such as automated XBRL report generation and ICT third-party provider management. The Enterprise plan costs €200 per user each month and includes tools for compliance with ongoing regulatory updates.

For example, a mid-sized European bank switched to a cloud-based DORA compliance platform and cut its compliance preparation time by 40% compared to manual processes [2].

Advantages include:

- Lower need for additional staffing upfront

- Predictable costs, making budgeting easier

- Simplified maintenance handled by the vendor

However, these benefits come with reduced flexibility - an issue explored further in the custom development section.

Drawbacks of Ready-Made Solutions

While a large insurer achieved 95% system coverage using a pre-built solution, they faced challenges with rigid workflows [2]. This underscores how off-the-shelf software can force operational compromises, particularly for complex organizations.

Challenges include:

- Limited features that may not fully address specific needs

- Risks of vendor lock-in

- Integration difficulties with existing systems

- Recurring subscription fees and potential feature restrictions

Ready-Made Software Overview

| Aspect | Impact | Key Factor |

|---|---|---|

| Implementation Speed | Faster than custom development | Quick path to compliance |

| Cost Structure | Predictable monthly/annual fees | Easier budget management |

| Maintenance | Vendor-managed updates | Reduces internal IT workload |

| Customization | Limited to vendor options | May require adjusting internal processes |

| Integration | Varies by vendor and systems | Compatibility with legacy systems needed |

For instance, one credit union reduced manual effort by 50% after adopting pre-built third-party risk tools [6][7].

Custom Development Analysis

Custom development offers a tailored alternative to off-the-shelf solutions, steering clear of vendor lock-in. However, it requires a significant commitment of resources. For organizations with unique needs that standard solutions can't address, this approach can be a game-changer - but it comes with its own set of challenges.

Benefits of Custom Development

Building a custom solution in-house allows organizations to meet specific DORA requirements with precision. Some key benefits include:

- Tailored functionality that aligns directly with DORA compliance needs.

- Smooth integration with existing workflows and operations.

- Enhanced control over sensitive financial data and security protocols.

- Faster response to regulatory updates and changes.

A survey found that 66% of financial institutions believe custom software gives them an edge in managing compliance [4]. This makes it particularly appealing for organizations with intricate operational structures where standard solutions fall short.

Challenges of Custom Development

Despite its advantages, custom development comes with notable risks and demands:

- Higher initial costs, often 2-3 times more than pre-built solutions [6].

- Longer development timelines, averaging between 4-9 months [8].

- Ongoing maintenance, requiring updates and adjustments over time.

- Specialized expertise, both technical and regulatory, is essential.

For example, a mid-sized German financial institution faced delays during an 18-month development project when new regulatory guidelines were introduced [2]. This highlights the need for systems that can handle evolving regulations even during development.

Custom Development at a Glance

| Aspect | Details |

|---|---|

| Initial Investment | 2-3x higher than off-the-shelf solutions [6] |

| Development Time | 4-9 months on average [8] |

| Success Rate | 62% in the financial sector [4] |

| Regulatory Updates | Managed internally by the organization |

"Custom solutions became more cost-effective after 3-5 years for large institutions with complex compliance needs, while smaller organizations found off-the-shelf solutions more economical in the long run", according to a financial consulting firm's analysis [2].

Notably, 72% of financial institutions cite regulatory compliance as their primary reason for pursuing custom development [4]. This underscores the demand for solutions that can keep pace with changing requirements.

Decision Factors

When financial institutions decide on their approach to DORA compliance, they need to consider three main areas:

Budget Analysis

Understanding costs is critical, as they depend on the type of solution selected.

| Off-the-Shelf | Custom | |

|---|---|---|

| Initial Cost | €100K-€500K | €500K-€2M |

| Annual Cost | Subscription-based | €100K-€300K |

Custom solutions often come with unpredictable costs, including potential infrastructure upgrades and other unforeseen expenses.

Growth Requirements

Institutions should assess how well the solution supports their growth and compliance needs:

- Regulatory Updates: Off-the-shelf tools often include automatic updates to meet changing regulations.

- Cross-Jurisdictional Rules: These solutions may better address DORA’s third-country provider requirements.

- Integration Needs: Compatibility with existing legacy systems is crucial for scalability and long-term success.

Setup Time and Complexity

The time required to implement a solution can significantly affect compliance readiness, especially with the 2025 deadline looming.

- Pre-built solutions can often be up and running within 10 days [5].

- Custom solutions, on the other hand, generally take 6-18 months to develop [1].

Statistics show that 70% of pre-built solutions are implemented within 3 months, compared to just 25% of custom projects meeting 6-month timelines [1][3].

Pre-built options also minimize technical overhead with cloud-based infrastructure, while custom solutions require extensive internal resources and specialized expertise.

sbb-itb-107f699

Implementation Examples

Small Bank Using DORApp

A regional European bank with 500 employees and €5 billion in assets serves as a great example of how standardized platforms can simplify operations. As highlighted in Ready-Made Software Benefits, these solutions are ideal for smaller institutions that prioritize speed and minimal technical complexity. This aligns with insights from Decision Factors, which stress the importance of reducing technical overhead for leaner organizations.

The bank leveraged DORApp to handle most of its compliance requirements with limited IT involvement. A standout feature was automated reporting, which streamlined the process significantly [1][2].

Large Bank's Custom Solution

Larger institutions often need tailored systems, as shown by a multinational bank operating across the EU. With over 50,000 employees and €500 billion in assets, this organization reflects the findings from Custom Development Risks and Growth Requirements. Custom solutions are often the best fit for institutions of this scale due to their complexity and broader operational demands [2][6].

Key aspects of the project included:

| Implementation Aspect | Details |

|---|---|

| Integration | Seamless connection with existing risk systems and security operations |

| Key Feature | Real-time compliance monitoring capabilities |

| Coverage | Comprehensive support for all EU jurisdictions |

One of the solution's strengths was its advanced incident response automation, which integrated directly with the bank's security operations center (SOC). This allowed for quicker and more efficient handling of compliance and security issues [2][6].

The bank's Chief Technology Officer highlighted the value of aligning the custom system with existing workflows, noting its ability to adapt to ever-changing regulations across EU countries. This adaptability made the upfront investment worthwhile [2][6].

Making the Final Choice

Main Points Review

When comparing the two approaches, 62% of EU financial institutions use off-the-shelf tools, while 28% rely on custom-built systems [8]. This reflects the practical differences in setup times: off-the-shelf solutions typically take 3-6 months to implement, whereas custom systems can require 9-18 months for development [6]. A notable example is Banco Santander's custom "SantanderShield" platform. Despite its €15 million investment, it achieved a 75% reduction in false positive alerts by integrating seamlessly with their existing systems.

Decision Guide

Based on the insights from the Budget Analysis and Implementation Examples sections, financial institutions should focus on three crucial factors:

1. Size and Complexity of Operations

Smaller institutions with simpler operations may find off-the-shelf solutions like DORApp more suitable. These tools provide core features such as automated XBRL reporting and third-party management without requiring extensive technical expertise. On the other hand, larger organizations with intricate systems might need custom solutions that can manage complex integration demands.

2. Organizational Scale

Case studies of regional banks and multinational institutions show that the size of an organization often dictates the best approach. Banco Santander's CTO Carlos Rodríguez sheds light on this:

Our hybrid approach balanced standardized components with custom development where needed.

3. Timeline and Development Capacity

With the 2025 compliance deadline looming, setup time becomes a critical factor. Institutions without the capacity for lengthy development projects should consider their technical resources and timelines carefully before committing to a solution.

FAQs

Here are answers to common questions based on challenges discussed in earlier case studies:

What is the difference between in-house software and off-the-shelf software?

In-house software gives you full control and customization, while off-the-shelf solutions are quicker to implement - especially important with the 2025 deadline looming. Custom-built tools allow organizations to create features tailored to their specific DORA compliance needs, whereas pre-built options focus on speed and ease of deployment.

What is the difference between custom software and off-the-shelf solutions?

The decision hinges on your operational priorities, as seen in the Implementation Examples. Custom software allows for seamless integration with older systems and aligns closely with existing processes (as shown in the Large Bank Case Study). Meanwhile, off-the-shelf solutions are faster to deploy but may need extra modifications to meet DORA standards.

| Aspect | Custom Software | Off-the-shelf Solutions |

|---|---|---|

| Integration Capability | Works seamlessly with legacy systems | May require additional connectors (see Integration Needs in Decision Factors) |

| Update Speed | Faster (weeks to implement updates) | Slower (depends on vendor timelines) |

| Support Model | Managed by internal teams or contracted developers | 24/7 support provided by the vendor |

"Custom solutions adapt faster to new requirements than vendor-dependent systems [1][2]."