Managing third-party risks is now more critical than ever for financial institutions in 2025. With over 60% of institutions reporting cybersecurity incidents and the new DORA (Digital Operational Resilience Act) in effect, compliance and operational resilience are top priorities. Here’s what you need to know:

- DORA Compliance: Requires ICT risk frameworks, resilience testing, and vendor oversight. Non-compliance can lead to fines up to 1% of daily global turnover.

- Key Tools: Advanced platforms like DORApp, SecurityScorecard, OneTrust, ComplyScore®, and Prevalent offer automation, real-time monitoring, and compliance support.

- Top Features: Automated risk assessments, continuous monitoring, AI-powered tools, and DORA-compliant reporting.

- Market Growth: The third-party risk management market is projected to grow from $8.3 billion in 2024 to $18.7 billion by 2030.

Quick Comparison of Tools:

| Platform | Strengths | Pricing | Best For |

|---|---|---|---|

| DORApp | DORA compliance, XBRL reporting | $218/user/month | Mid-sized institutions |

| SecurityScorecard | AI-driven monitoring, breach reduction | Custom | Large institutions |

| OneTrust | Automated assessments, ESG focus | Custom | Mid-sized institutions |

| ComplyScore® | Modular setup, audit trails | Custom | Large institutions |

| Prevalent | Real-time insights, dark web scans | Custom | All sizes |

Takeaway: Financial institutions must act quickly to adopt these tools to ensure compliance, mitigate risks, and streamline vendor management in a rapidly evolving regulatory landscape.

How Does DORA 360 Help With Third-Party-Risk Management

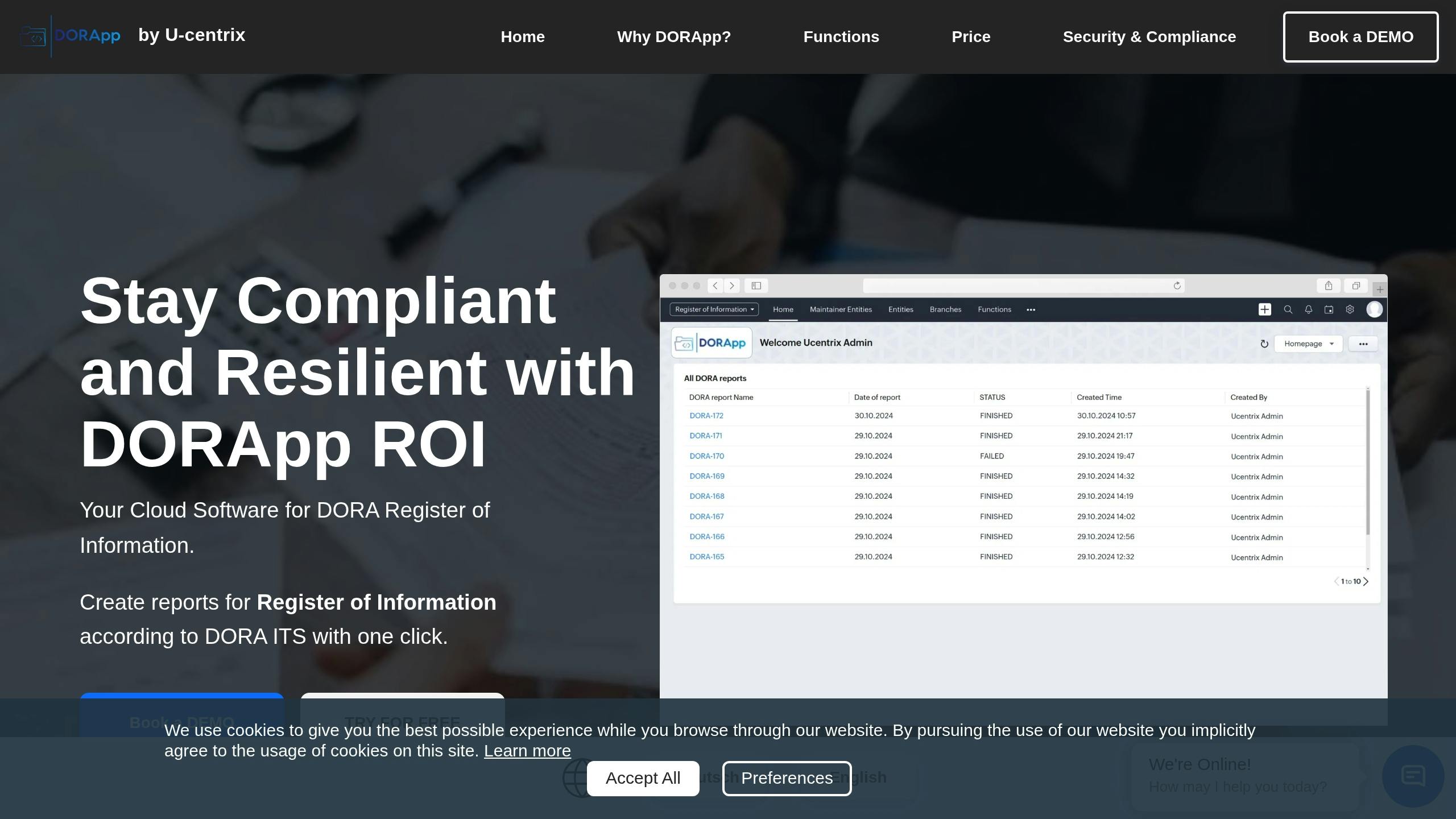

1. DORApp

DORApp is a cloud-based platform designed to help financial organizations meet DORA compliance requirements by 2025. Created by U-centrix d.o.o., this SaaS tool focuses on automating third-party risk management and regulatory compliance.

By automating key tasks, DORApp reduces management effort by 50–70%, allowing teams to focus on other priorities. It handles ICT risk assessments, including tasks like vulnerability scanning and patch management, with ease.

The platform also tracks ICT third-party contracts as required by DORA, flags potential risks, and helps organizations avoid penalties that can reach up to EUR10 million (around $10.6 million) or 10% of annual turnover. These features work alongside robust security and compliance measures.

"We estimate that with Dynatrace, organizations can automate up to 80% of the technical tasks necessary to be DORA compliant, helping reduce the overall required time and personnel by 50–70%. Unifying observability and security not only helps save significant time and effort, it also provides the necessary visibility into the organization's IT environment and helps to achieve continuous compliance."

– Bernd Greifeneder, Founder and Chief Technology Officer, Dynatrace

DORApp includes advanced security features like multi-factor authentication, IP filtering, location-based geo-fencing, and ISO27001-certified protocols. It also complies with GDPR standards and uses public data sources, such as LEI databases, to improve risk assessments. Audit trails are maintained to ensure regulatory compliance.

The platform simplifies reporting by automatically generating DORA-compliant XBRL reports, reducing manual work and errors. Pricing starts at approximately $218 per user per month, with an enhanced package - including expert training - available for about $436 per user per month.

Recent data shows that 47% of chief information security officers in the United Kingdom and 38% in the European Union have spent over €1 million on DORA compliance.

DORApp's integration capabilities allow it to connect smoothly with existing ICT systems, ensuring continuous compliance. For organizations managing multiple third-party relationships, this automation supports real-time risk assessment and compliance monitoring.

2. Risk Management Platform Analysis

SecurityScorecard's Supply Chain Detection and Response (SCDR) platform offers a powerful solution for financial institutions preparing for DORA compliance. Using AI-driven technology, the platform has shown to reduce third-party breach incidents by 75% and speed up issue resolution by 90%.

The platform provides real-time monitoring, continuously scanning the supply chain and issuing instant alerts. This feature aligns with DORA's requirements for ongoing ICT oversight and proactive risk management, making it a key component of the platform's capabilities.

"SecurityScorecard MAX bolsters our third-party cybersecurity posture quickly and efficiently through proactive, real-time risk monitoring and remediation. With MAX, we unlock the ability to identify a wide range of cybersecurity concerns across our global vendor landscape and partner with those vendors to respond to and eliminate threats in our supply chain." – Kevin Scribner, Director of Technology Risk Management at McDonald's

The platform's AI-enhanced questionnaire simplifies assessments, cutting completion time by 83%. This allows for more frequent and detailed evaluations across multiple third-party relationships.

Key Features of the Automated Risk Response System

| Feature | Benefit |

|---|---|

| Continuous Monitoring | Instant alerts on changes in vendor security posture |

| AI-Powered Assessment | Automated detection of fourth-party risks |

| Centralized Risk Register | Consolidated view of all vendor-related risks |

| Automated Response Playbooks | Simplified and efficient incident resolution |

"A TPRM program supported by security ratings is essential for developing security controls, but it is not equipped to operationalize risk and threat intelligence to reduce the frequency and severity of third-party cyber incidents. The implementation of MAX strengthens security by powering teams of supply chain incident responders who can work directly with vendors to quickly resolve issues." – Mignona Cote, Chief Security Officer, NetApp

The platform goes beyond monitoring by supporting compliance efforts. It maintains detailed records of ICT providers and automates stress tests to ensure operational resilience, meeting DORA's strict documentation standards.

For financial institutions wary of regulatory penalties - potentially up to 1% of the provider's average daily global turnover - SecurityScorecard provides evidence-based intelligence and compliance tracking. These tools help create reliable audit trails and meet reporting requirements.

Additionally, the platform integrates seamlessly with existing financial systems. This ensures uninterrupted operations and supports risk management processes, meeting DORA's requirement for vendor replacement without disruptions.

3. Third-Party Risk Software Review

OneTrust is a powerful tool designed to help financial institutions gear up for DORA compliance in 2025. It automates the creation of a DORA-compliant register and includes compliance data screening - important since 29% of breaches are linked to third-party vendors.

The platform offers features like automated vendor risk assessments, continuous monitoring for DORA compliance, AI-driven risk scoring, and integration options via REST API and SDK. These tools make it easier to align with regulatory demands while streamlining workflows within existing financial systems.

"Amid growing global mandates for cyber resiliency like DORA, teams need a deep understanding of their extended enterprise and tools for managing risk at scale. By expanding on our robust Third-Party Management capabilities with game-changing, new capabilities, teams can gain much-needed visibility, automate risk and compliance management, and strengthen resilience." - Shiven Patel, Director of Third-Party Management at OneTrust

The global market for third-party risk management is expected to grow significantly, from $8.3 billion in 2024 to $18.7 billion by 2030.

To meet DORA's requirements, OneTrust includes features for detailed contractual documentation and automated annual reporting. These functions address the need for thorough documentation and regular reviews of ICT service providers, as mandated starting April 30, 2025.

The platform's risk assessment framework covers several key areas: financial risk, operational resilience, compliance tracking, reputational risk, and ESG considerations. This approach helps financial institutions stay compliant while managing vendor relationships effectively, aligning with the increasing focus on integrated governance, risk, and compliance strategies.

sbb-itb-107f699

4. Financial Compliance Software Assessment

In the realm of risk management tools, ComplyScore® stands out as a solution designed to meet DORA compliance requirements. Its API-driven design integrates effortlessly with existing fintech systems while upholding strict security standards.

By automating assessments, ComplyScore® cuts vendor evaluation time by 44%, saving an average of 8.3 days. At the same time, it ensures detailed audit trails are maintained for DORA compliance.

Here’s a breakdown of the platform’s key features:

- Vendor Inventory: Automatically maps and classifies providers to align with DORA’s classification requirements.

- Contract Management: Manages digital documentation with built-in audit trails, ensuring compliance with contractual obligations.

- Risk Monitoring: Offers real-time alerts and continuous assessments to help address risks proactively.

- Reporting: Generates automated DORA-compliant reports, simplifying regulatory submissions.

Data shows that organizations adopting ComplyScore® have seen a 3- to 4-fold productivity boost, thanks to its automation and streamlined workflows.

The platform’s modular setup allows financial institutions to customize it to their needs while staying compliant with DORA. This adaptability is critical, as non-compliance could lead to penalties of up to 1% of a provider’s average daily global turnover.

In real-world applications, ComplyScore® has delivered measurable results. For example, a major U.S. bank used the platform to streamline workflows and improve operational efficiency while staying fully compliant with regulations. Its pre-configured risk assessments have also simplified vendor onboarding, making it a preferred option for financial institutions preparing for DORA’s 2025 implementation.

5. Risk Control System Evaluation

Prevalent Vendor Threat Monitor offers a powerful ICT third-party risk management solution tailored for financial institutions. Using an AI-driven platform, it scans thousands of sources to provide up-to-date insights on vendor vulnerabilities, network conditions, and potential security issues, all aligned with DORA's framework.

The platform's unified risk register brings together monitoring and assessment data, making compliance efforts more efficient. Financial institutions have reported better risk detection thanks to its continuous monitoring capabilities.

Here’s a snapshot of its key features:

| Feature | Purpose | Outcome |

|---|---|---|

| AI‐Enabled Intelligence | Monitors thousands of data sources | Provides real-time risk insights |

| Dark Web Monitoring | Tracks cyber threats and risks | Improves threat detection |

| Automated Risk Response | Executes mitigation using playbooks | Simplifies risk management |

| Unified Risk Register | Centralizes vendor data | Supports DORA compliance |

The platform also enhances oversight with automated summaries and rule-based alerts. Beyond cyber threats, it monitors operational, reputational, financial, and sanctions-related risks.

Daily AI-generated event summaries keep stakeholders informed by delivering concise updates on critical cyber, business, and financial risks via email. This ensures users stay updated without being overwhelmed by excessive data.

Software Comparison Analysis

This analysis outlines the differences in DORA compliance, integration capabilities, and risk management features among top third-party risk management platforms.

| Feature/Platform | DORApp | Archer | Diligent One | UpGuard |

|---|---|---|---|---|

| Overall Rating | Not rated | 8.1/10 | 8.4/10 | 4.5/5 |

| DORA Compliance | Native support | Partial | Partial | Limited |

| Pricing | $218/user/month | Custom | Custom | Free trial available |

| Support Rating | Not rated | 5.3/10 | 10.0/10 | High |

| Risk Management | Basic | 9.5/10 | 7.8/10 | Advanced |

| Integration | Public data sources | Extensive | Limited | IPv4 scans |

| Key Strength | XBRL reporting | GRC policy | Ease of use | Security ratings |

Archer stands out in governance and compliance, boasting a 9.5/10 GRC rating. It offers strong integration capabilities and rapid development, though users mention its usability could improve, citing a 7.0/10 score due to a cumbersome menu system.

Diligent One, on the other hand, is praised for its exceptional support, earning a perfect 10.0/10 support rating. While it excels in business compliance, some users highlight its limitations in third-party risk management (TPRM) features and cost-effectiveness, contributing to its overall 8.4/10 rating.

DORApp focuses on specialized DORA compliance, offering features like automated XBRL report generation and integrated LEI data enrichment. Priced at $218 per user per month, it appeals to organizations prioritizing these capabilities. However, its offerings differ significantly from competitors, catering to specific compliance needs.

Platform efficiency also varies widely. For instance, MetricStream has reduced onboarding time by 80% with automated workflows, while SecurityScorecard has cut questionnaire completion times by 83% through automation. Meanwhile, ProcessUnity continues to evolve, showcasing progress in the ever-changing market.

"Our efforts this year set the foundation for an even more successful 2025. We have ambitious plans for our platform, zeroing in on bringing TPRM solutions that combine the power of data and AI to market. 2025 is set to be our biggest year of innovation yet." - Sean Cronin, CEO

Given the high-risk environment, financial organizations must prioritize platforms that deliver strong DORA compliance, seamless integration, thorough risk assessment tools, dependable support, and scalable cost-effective solutions.

Recommendations and Future Outlook

Based on an in-depth review of top TPRM platforms, specific recommendations emerge for organizations of different sizes:

- Large financial institutions: For those managing complex vendor ecosystems, ComplyScore® stands out. Its advanced analytics and AI-driven assessments make it ideal for handling extensive vendor networks. The platform's ability to provide tailored risk profiles and proactive risk management is a major advantage.

- Mid-sized institutions: DORApp is a strong fit here. It offers streamlined compliance with DORA regulations, including built-in support for automated XBRL reporting. This makes it a practical choice for addressing EU regulatory requirements efficiently.

- Small institutions: Smaller organizations can turn to UpGuard for affordable and effective cybersecurity monitoring. Features like security ratings, automated assessments, and real-time tracking make it a reliable option for managing risks without breaking the budget.

These recommendations align with the earlier evaluations, emphasizing how each platform meets specific needs while addressing DORA compliance. Beyond meeting current regulations, these tools also prepare institutions for upcoming advancements in technology.

"We invested heavily into completing the integration of our two companies, continued to innovate and up-level our customers, and grew as a business." - Sean Cronin, CEO

The growth in TPRM technology is a direct response to rising cybersecurity threats and stricter regulatory requirements.

"DORA is clearly designed to protect consumers from losing access to their financial records and resources, no matter where a disruption originates or occurs - including at a third party." - Loren Johnson, Senior Director, Product Marketing at Aravo

Looking ahead, TPRM software is expected to incorporate more advanced AI, real-time monitoring, and automated workflows. To stay ahead, financial entities should:

- Opt for platforms that seamlessly integrate with existing GRC and procurement systems while offering continuous, AI-powered risk assessments.

- Ensure scalability to support growing vendor networks and adapting regulatory landscapes.

- Choose solutions with automated compliance features and real-time monitoring capabilities.

With TPRM adoption projected to become widespread by 2025, financial organizations need to act quickly. This will not only help them stay compliant but also gain a competitive edge in risk management.