No, Excel is not an appropriate tool for maintaining the DORA ICT Third-Party Register. While Excel is widely used, it struggles with DORA's complex requirements, such as managing relational data, ensuring security, and providing detailed audit trails. Financial institutions face risks like data errors, compliance failures, and operational inefficiencies when relying on Excel. Specialized tools like DORApp.eu or 3rdRisk are better suited, offering automated validations, secure collaboration, and compliance-ready features.

Key Issues with Excel:

- Data Management: Poor handling of interconnected data, leading to errors and redundancy.

- Security: Weak access controls and lack of robust protection for sensitive data.

- Collaboration: No multi-user support, causing version control problems.

- Compliance: Missing audit trails and automated reporting capabilities.

Why Switch to Specialized Tools:

- Enhanced Security: Strong access controls and data protection.

- Automation: Validations, XBRL reporting, and real-time updates.

- Scalability: Cloud-based systems for growing data needs.

- Audit-Ready: Detailed change logs and compliance evidence.

With the DORA compliance deadline (April 30, 2025) approaching, financial institutions must act quickly to adopt purpose-built solutions that ensure accuracy, security, and regulatory adherence.

Digital Operational Resilience Act (DORA) Compliance through Vendor and Contract Management

Problems with Using Excel for the DORA ICT Register

During the December 2024 dry run, Excel's weaknesses in meeting the demands of DORA compliance became clear. While it's widely used by financial institutions, Excel struggles to handle the complexity required for this task.

Handling Relational Data

Excel's flat structure creates challenges when dealing with DORA's interconnected data requirements. Problems include:

- Data redundancy and inconsistencies across multiple spreadsheets.

- Difficulty managing links between service providers, contracts, and business functions.

- Increased risk of errors when using formulas to track dependencies.

Missing Key Features

Excel lacks several important features needed to maintain a DORA-compliant register. Here's how these gaps impact compliance:

| Missing Feature | Effect on Compliance |

|---|---|

| Multi-user Support | Limits collaboration and causes version control problems. |

| Intelligent Validations | Leads to data entry mistakes, increasing compliance risks. |

| Automated Updates | Manual updates are time-consuming and prone to errors. |

| Audit Trails | Makes it hard to track changes and provide compliance evidence. |

Scalability and Security Concerns

As organizations grow, Excel's shortcomings become more pronounced. For example, the Dutch Central Bank (DNB) announced in August 2024 that it would adopt the xBRL-CSV standard by 2025 [1][3]. Excel struggles to meet these evolving needs due to:

- Weak data protection measures.

- Poor access management capabilities.

- Insufficient security features to safeguard sensitive ICT provider details.

Given these issues, it's clear that financial institutions need purpose-built tools to meet DORA compliance requirements effectively.

Risks of Using Excel for DORA Compliance

Relying on Excel for DORA compliance introduces operational and regulatory challenges that can jeopardize a financial institution's ability to meet requirements effectively.

Data Integrity and Accuracy

Excel's limitations make it prone to compliance issues, such as:

- Errors from manual data entry and lack of proper validation tools

- Inconsistent data due to poor version control and weak change-tracking features

- Challenges in enforcing uniform formats and rules

- Higher risk of penalties and audit failures caused by inaccurate data

Operational Inefficiencies

Excel's manual nature adds unnecessary strain to operations:

"The complexity and vast data required in DORA compliance are challenging and have the potential to significantly impact operational processes, demanding significant time and effort to gather information, navigate multiple Excel tabs, and find DORA-specific coding values." [3]

This can lead to:

- Heavy resource demands for consolidating and overseeing data

- Delays in reporting processes

- Increased costs from fixing errors and duplicating efforts

Security and Audit Limitations

Regulatory bodies like the EBA and BaFin [1][2] highlight how Excel's security framework falls short of DORA's standards:

- Basic access controls that don't meet financial industry needs

- Lack of detailed audit trails for compliance verification

- Greater exposure to data breaches and unauthorized changes

- Difficulty proving compliance during regulatory audits

The Swiss financial regulator also stresses that achieving DORA compliance requires advanced security and audit features - capabilities that Excel simply cannot provide [1].

These risks make it clear: financial institutions need to move to specialized tools built for managing DORA compliance.

sbb-itb-107f699

Alternatives to Excel for DORA Compliance

The December 2024 dry run revealed Excel's limitations in managing the DORA ICT Third-Party Register. Financial entities now need to explore better tools to meet compliance requirements effectively.

Developing Custom Software

Building custom software can be an option for organizations looking for a tailored solution. However, it comes with its own set of pros and cons:

Advantages:

- Fully customizable workflows and features

- Seamless integration with existing systems

- Full control over security and compliance protocols

Challenges:

- High initial investment

- Ongoing maintenance demands

- Long development timelines

- Requires in-house technical expertise

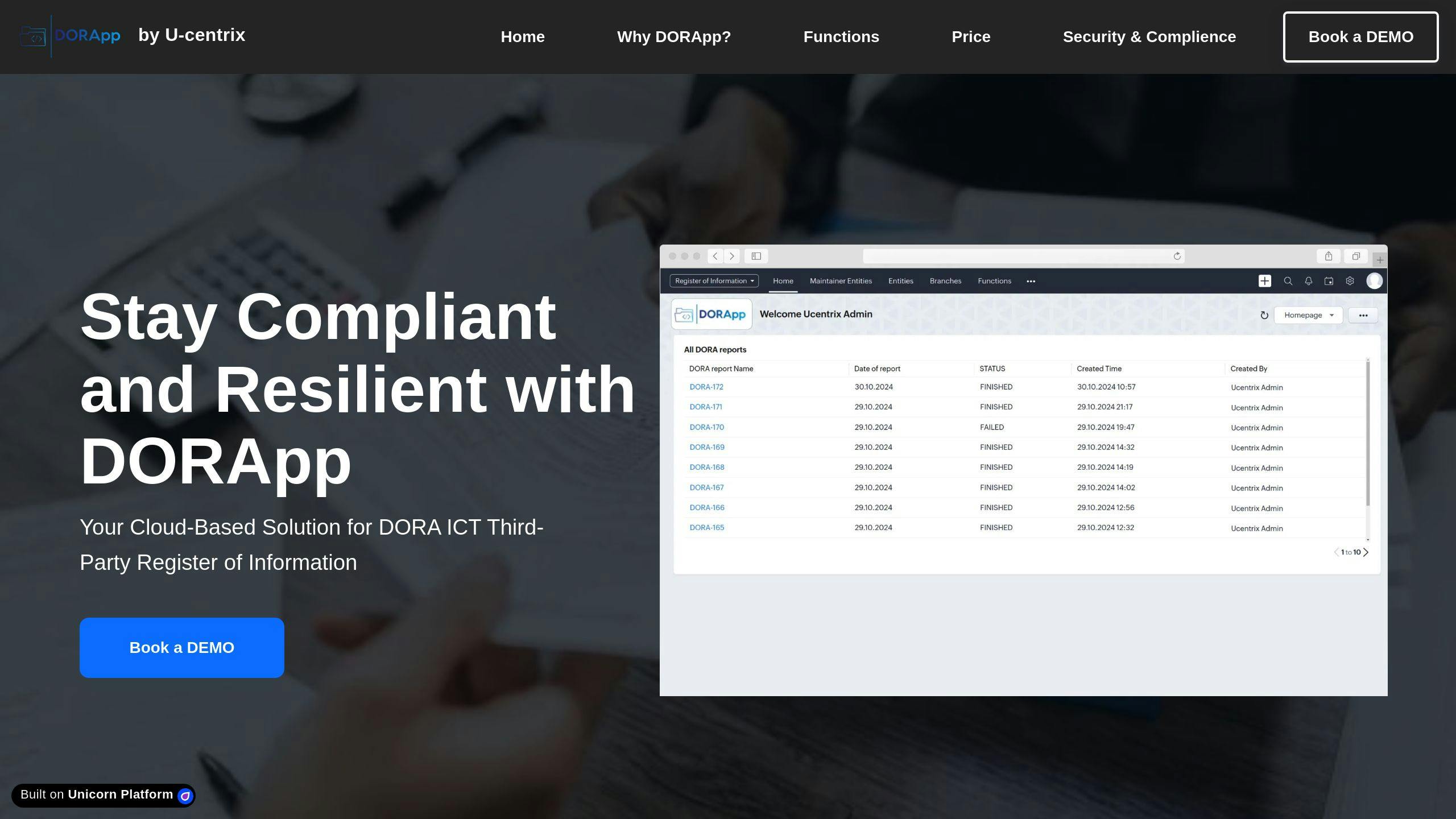

DORApp.eu: A SaaS Solution for DORA Compliance

DORApp.eu offers a specialized platform designed to simplify DORA compliance. Its features include:

- Automated XBRL report generation

- User-specific permissions for secure collaboration

- Detailed audit trails

- GDPR-compliant cloud hosting for secure data management

Excel vs. Specialized DORA Tools: A Comparison

| Feature | Excel | Specialized DORA Tools |

|---|---|---|

| Data & Collaboration | Manual entry, limited sharing | Automated validation, real-time collaboration |

| Security | Basic controls | Enterprise-grade protection |

| Audit Capabilities | Manual tracking | Automated, detailed audit trails |

| Scalability | File size limits | Cloud-based, scalable solutions |

| Reporting | Manual compilation | Automated XBRL generation |

Other Specialized Tools for DORA Compliance

Several other vendors provide solutions tailored for DORA compliance:

- 3rdRisk: Known for its advanced third-party risk management features, 3rdRisk is praised for being user-friendly and aligned with the latest industry standards. Bodrik Bakker, Business Developer, explains: "3rdRisk is our go-to platform for third-party risk and compliance management. Why? Because it's based on the latest standards in our field, highly flexible, intuitive, and pleasant to work with."

- Panorays: This platform simplifies compliance with automated reporting and pre-built questionnaire templates, minimizing the risk of errors.

The best choice depends on the size of the organization, the complexity of its operations, and available resources. For many financial entities, specialized SaaS tools strike the perfect balance of ease of use and advanced functionality. Once a tool is selected, it’s crucial to ensure a smooth transition to maintain compliance seamlessly.

Steps to Switch to a DORA-Compliant Solution

With the January 17, 2025, DORA compliance deadline closing in, financial institutions need a clear plan to transition from Excel-based ICT registers to specialized solutions. Here's how to make the switch as smooth as possible.

Planning and Moving Data

Preparation is key to a successful transition. State Street's global implementation program highlights the importance of a well-structured approach to data migration.

Data Assessment and Cleanup

- Audit and clean your data by spotting inconsistencies, removing duplicates, and standardizing formats.

- Assign unique identifiers to providers and validate the data to meet DORA's requirements.

Data Mapping Strategy

- Map current data fields to the new system, define relationships between components, and document dependencies and hierarchies.

- Build a detailed migration timeline with clear checkpoints.

Once your data is clean and mapped, the focus shifts to ensuring your team can effectively use the new system.

Training and Implementation

Training and change management are essential for a smooth transition. Proper training equips your team to meet DORA's demands by the April 2025 deadline.

| Phase | Key Activities | Success Metrics |

|---|---|---|

| Initial Training | System training and DORA overview | User competency assessments |

| Pilot Testing | Testing with select users | Issue identification and resolution |

| Full Rollout | Gradual implementation by department | System adoption rates |

| Ongoing Support | Help desk setup and documentation | Support ticket resolution time |

Maintaining Compliance

Staying compliant requires continuous monitoring and regular updates after the system is in place. Veronica Vela from Chemily Information Management Company stresses the importance of robust authentication:

"We have thousands of users who view their utility bills online, and they're authenticated properly. Nobody is able to access information they're not authorized to see."

Key Maintenance Activities:

- Conduct quarterly audits of the ICT register.

- Update provider details as soon as changes occur.

- Perform monthly data quality checks.

- Review user access rights every quarter.

- Document all system changes.

These practices reduce the risk of penalties and operational issues. Financial institutions should establish clear guidelines for:

- Updating provider information.

- Tracking and managing incident reports.

- Controlling system access.

- Regularly reviewing compliance.

- Keeping audit trails up to date.

Ongoing updates and monitoring ensure data accuracy and compliance, helping institutions maintain resilience while meeting DORA standards.

Conclusion: Choosing the Right Tool for DORA Compliance

The December 2024 dry run highlighted Excel's shortcomings in meeting DORA's complex demands, despite initial recommendations from ESA. This has made it clear that financial institutions must adopt tools designed specifically to address DORA's strict requirements.

"Those who invest early in a structured and efficient solution will be well-prepared not only to meet the new regulatory requirements but also to benefit in the long term from the insights gained" [1].

Excel falls short due to its inability to manage relational data, lack of critical features, and limited security controls. As a result, the financial industry is moving towards specialized tools that can effectively manage the intricacies of compliance.

Platforms like DORApp.eu provide features that Excel cannot match, such as:

- Enhanced security and controlled access

- Automated validation and reporting workflows

- Detailed audit trails and compliance documentation

Adopting these specialized solutions not only ensures compliance but also bolsters digital resilience. With the January 17, 2025 deadline fast approaching, financial institutions need to act swiftly to implement reliable, purpose-built tools that safeguard data integrity and meet DORA's stringent standards.

FAQs

What is the DORA Register of Information tool?

The DORA Register of Information is a required database designed to monitor agreements with ICT third-party service providers. It focuses on tracking critical functions and vendor relationships.

Why isn't Excel effective for DORA compliance?

Excel falls short for DORA compliance because it can't handle relational data, lacks proper multi-user functionality, and doesn't provide audit trails or strong security measures.

What features are essential in a DORA-compliant solution?

A DORA-compliant solution should include the following features:

| Feature Category | Key Capabilities |

|---|---|

| Data Management | Relational data handling, Automated validations |

| Security | Multi-factor authentication, Location-based access controls |

| Compliance | Audit trails, Automated reporting (e.g., XBRL, LEI integration) |

| User Management | Multi-user support, Role-based access control |

When is the deadline for DORA compliance?

Financial entities must meet all DORA compliance requirements by January 17, 2025. This includes implementing effective ICT third-party risk management tools and processes.

How can organizations move from Excel to a DORA-compliant solution?

Transitioning involves three main steps:

- Careful planning and preparation of data

- Systematic migration of data

- Training employees on the new system

Tools like DORApp.eu offer built-in migration features and training programs to simplify this process.